Americans are more bearish on President Donald Trump’s economy than ever.

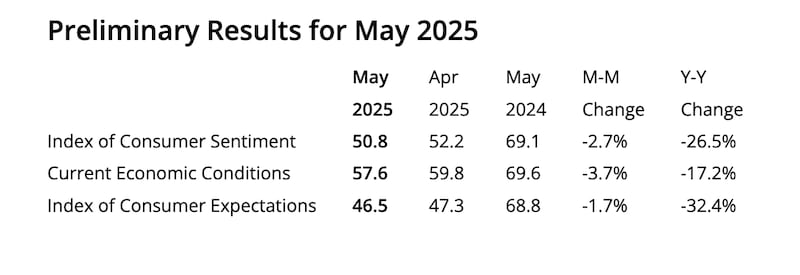

A preliminary reading for May determined the U.S. consumer sentiment index had dropped to 50.8, down from 52.2 in April. That is the second-lowest reading on record, behind June 2022, and is the lowest ever under Trump’s leadership.

May’s preliminary index is 30 points below what it was when Trump returned to office in January. It is also significantly lower than the annual index average during the Great Recession, which was 63.7 in 2008 and 66.3 in 2009.

ADVERTISEMENT

The latest figures were released Friday by the University of Michigan, which surveyed Americans about their confidence in the economy. Many respondents said Trump‘s tariffs had them fearing a spike in inflation.

“Tariffs were spontaneously mentioned by nearly three-quarters of consumers, up from almost 60% in April,” the university said. “Uncertainty over trade policy continues to dominate consumers’ thinking about the economy.”

Interviews for the survey were conducted between April 22 and May 13, closing two days after Trump announced a 90-day pause on tariffs for Chinese imports. Still, the survey said respondents had just a small bump in confidence in the days after the tariffs were paused on China.

“These initial upticks were too small to alter the overall picture—consumers continue to express somber views about the economy,” the university wrote. It has released the consumer sentiment index since 1961.

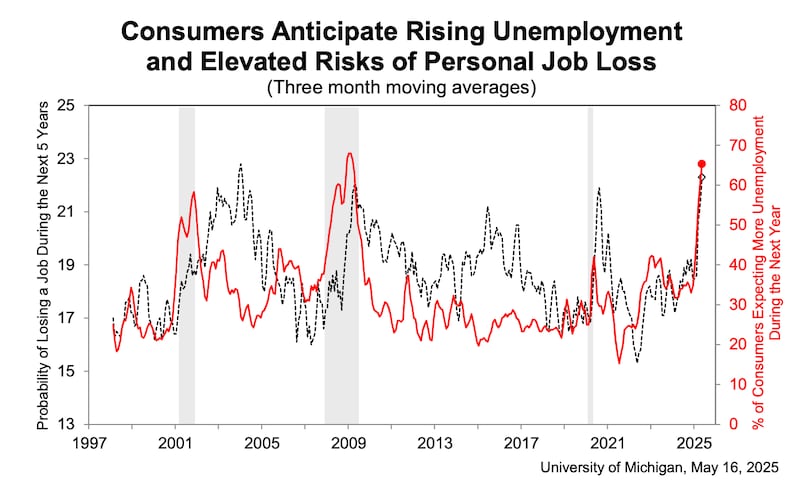

Economists’ projections are in line with the public’s fears about inflation. The survey said year-ahead inflation expectations rose to 7.3% in May, up from 6.5% last month, while long-term inflation expectations rose to 4.6% from 4.4%.

While tariffs are much lower than their “Liberation Day” peak of early April, CNBC reports they remain “significantly higher today” than they were before Trump‘s inauguration.

The next consumer index report will be released on May 30. It is expected to shed more light on whether Trump‘s tariff pause for China has eased Americans’ fears about an economic decline.