The fight between Donald Trump and Elon Musk over the GOP tax bill caused even more problems for Musk’s electric car company, Tesla, Thursday.

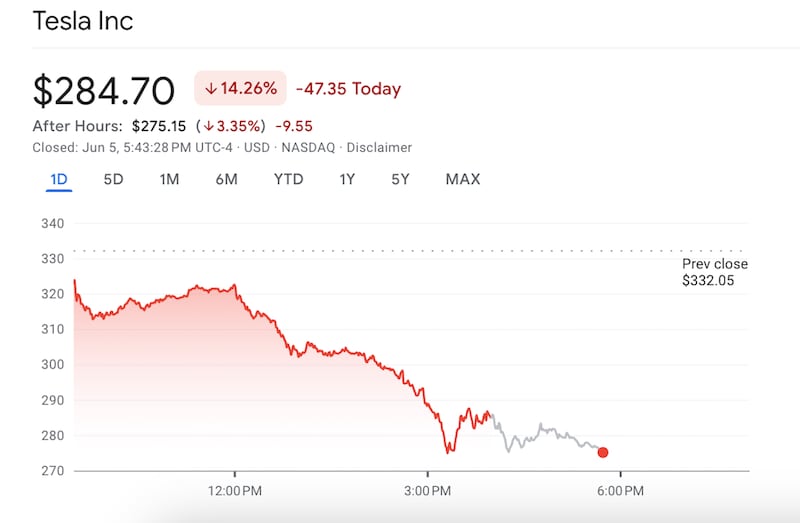

Musk’s public disagreement with the president, centered around the legislation’s proposal to end clean energy tax credits, contributed to Tesla’s stock price tumbling more than 10 percent as of publication Thursday afternoon.

At the opening bell, one share of Tesla was worth about $322. Its value is currently listed at just under $300, with a substantial drop coming after Trump torched Musk from the Oval Office.

“Elon and I had a great relationship. I don’t know if we will anymore,” Trump said around noontime.

“I’m very disappointed with Elon,” he continued. “I’ve helped him a lot. He knew the inner workings of the bill better than anybody sitting here. He had no problem with it. All of a sudden he had a problem and he only developed the problem when he found out we’re going to cut the EV [Electric Vehicle] mandate.”

Musk, who was obviously listening, shot back on X minutes later: “False, this bill was never shown to me even once and was passed in the dead of night so fast that almost no one in Congress could even read it!”

“Without me, Trump would have lost the election,” added Musk, who donated about $275 million to Trump’s campaign. “Dems would control the House and the Republicans would be 51-49 in the Senate.”

Trump, he claimed, was showing “such ingratitude.”

The legislation that Trump has affectionately called the “One, Big, Beautiful Bill” would do away with a tax credit worth up to $7,500 for some Tesla models. This would cause Tesla to lose $1.2 billion this year alone, JPMorgan analysts predicted, according to Bloomberg.

That’s on top of an estimated $2 billion loss due to the Senate last month blocking a Biden-era Environmental Protection Agency waiver allowing California to ban gas-powered cars by 2035.

Tesla, in a social media post last week, warned that nixing the tax credit would “threaten America’s energy independence and the reliability of our grid.”

The company, which has more of Musk’s attention since his exit from the so-called Department of Government Efficiency, is coming out a rough first quarter in part due to the backlash to Musk’s slash-and-burn role at DOGE and the effect of Trump’s tariffs, which Musk opposed. Vehicle deliveries, for instance, fell nearly 13 percent in the first three months of the year, a period that saw several dips in stock prices.

To help counter that, Trump and Musk in March used the White House driveway to line up various Tesla models and urge Americans to buy them. Consumer sentiment didn’t appear to come around, though, as protests at Tesla dealerships and instances of vandalism continued.