Elon Musk is sounding the alarm as Tesla’s profit engine may be stalling due to his political entanglements and fallout with Donald Trump.

In a bleak second-quarter earnings call, Musk called it a “weird transition period” and told investors: “We probably could have a few rough quarters,” according to the Financial Times.

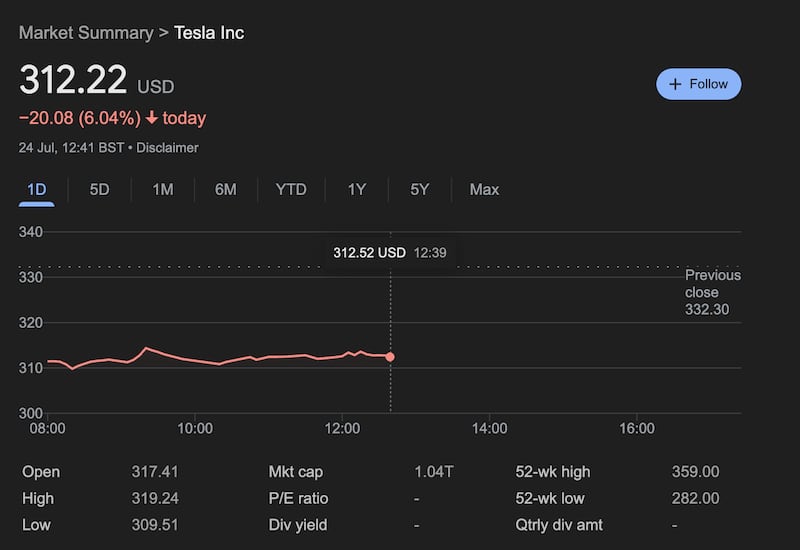

Tesla posted a 22 percent drop in net income to around $1.4 billion, with revenue down 12 percent to $22.5 billion. Shares slid 6 percent in pre-market trading and are now nearly 30 percent off their mid-December high. At the time of writing, the figure was 6.1 percent.

In the quarterly call, Musk—who has recently lost several top executives—also warned that “we will lose a lot of incentives in the U.S.”

He was pointing the finger at President Donald Trump’s signature “Big, Beautiful Bill,” which slashed EV and solar incentives and torpedoed the sale of regulatory credits to more polluting rivals, a major profit stream for Tesla. Revenue from those credits dropped nearly 50 percent year-over-year to $439 million this quarter—down from $2.8 billion in total last year.

Musk’s rocky detour into government has been a drag on his EV maker. The experiment slashing government as a special government employee with DOGE alienated longtime Tesla fans and helped trigger a wave of protests and boycotts. His eventual high-profile fallout with the president and vow to begin a third “America Party” rankled investors and hit the share price, too.

The company is also grappling with an outdated vehicle lineup and mounting pressure from both Chinese and Western electric vehicle competitors.

It reported adjusted net income of $1.4 billion for the April-June quarter—roughly in line with analyst forecasts but down more than 20 percent from $1.8 billion during the same period last year.

Tesla’s chief financial officer, Vaibhav Taneja, warned that the company’s vehicle supply is limited and may fall short of meeting demand if buyers rush to take advantage of the $7,500 federal tax credit before it expires in September.

The Big, Beautiful bill also puts pressure on Tesla’s broader operations by scrapping a variety of incentives tied to renewable energy.

Taneja said Tesla was hit with $300 million in extra tariff-related expenses during the second quarter alone—a number expected to rise in the coming months. Trump has raised tariffs on imported vehicles and components, including the battery cells Tesla sources from China.

“While we are doing our best to manage these impacts, we are in an unpredictable environment on the tariff front,” the Tesla CFO added.

The bleak U.S. news comes as sales have suffered in Europe. Tesla revealed last month that it delivered 384,122 vehicles for the quarter—falling short of analysts’ expectations of 389,000 and marking a 13 percent drop from the 443,956 units sold during the same period last year.

Tesla did not immediately respond when approached for comment by the Daily Beast.